What is CBAM?

According to CBAM regulation (Regulation (EU) 2023/956), it is determined which product groups are affected.

&

Steel

CBAM will be implemented over two periods.

Transition Phase

01. October 2023 - 31. December 2025

Reporting obligation

Penalties for false or incorrect reports of €10-50/tCO2

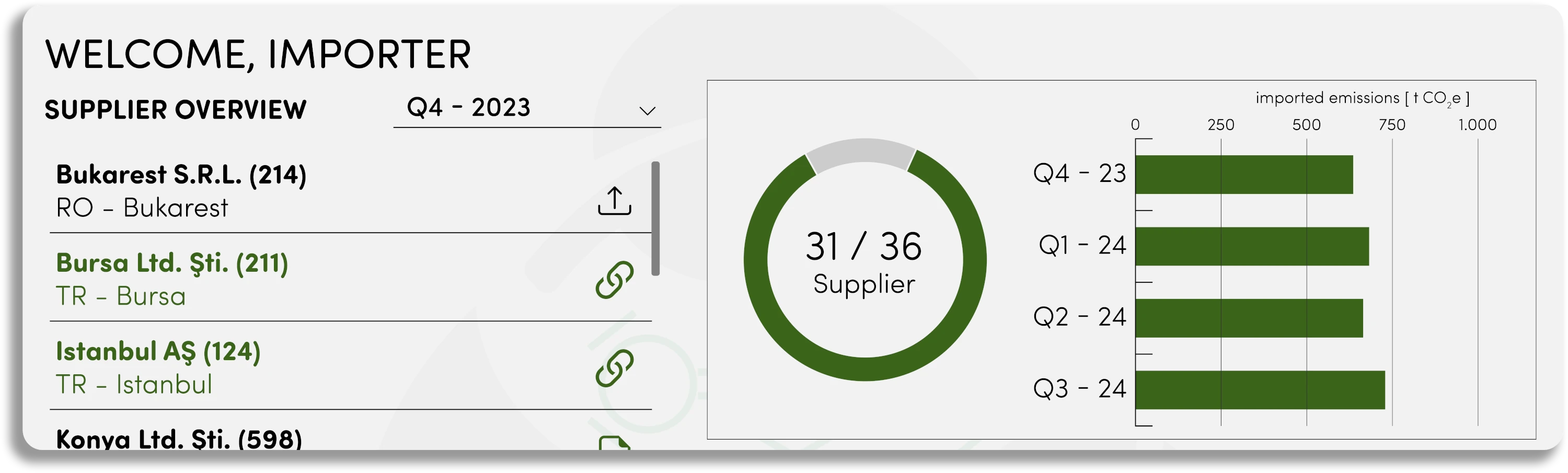

Quarterly report upload

Deadline for follow-up of the first 3 reports (Q4-2023, Q1-2024, Q2-2024) until 31 July 2024

Use of default values only permitted up to the Q2-2024 report

From the Q3-2024 report onwards, the new EU method or equivalent methods for calculating emissions are permitted

From 1 January 2025, only the new EU method is approved for calculating emissions

Pricing Phase

from 01. January 2026

Purchasing CBAM Certificates

The certificate price is based on the EU ETS CO2-Price

Certificates for at least 80% of the imported CO2-Quantity must be held by the company

Annual report upload